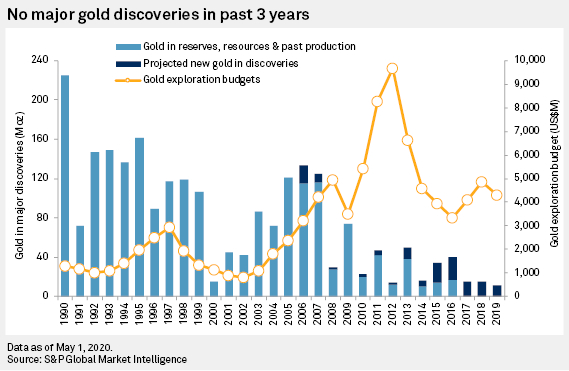

New gold discoveries have languished over the past ten years, but there may be upsides attached to the recent rise in gold prices because quality assets are in short supply over the short to medium term. According to an S&P Global Market Intelligence analysis on major gold discoveries, while 278 deposits containing 2,194.5 million ounces of gold in reserves, resources, and past production were identified over the 1990-2019 period, no major gold discoveries were made in the past three years, with only 25 in the past decade containing 154.3 million ounces, or 7% of all gold discovered. 1 This was primarily attributed to companies focusing on advanced-stage assets and known deposits.

There appears to be a larger industry shift away from risky grassroots exploration in favour of exploration at known deposits and around operating mines. Both pure explorers and producers have clearly adjusted their operational frameworks, with juniors increasingly expanding known deposits and producers directing their focus towards exploration at their existing operations. Although new major discoveries have been found at some late-stage projects and existing mining camps, data indicates that the potential to find new major discoveries at such projects is less than at riskier, early-stage prospects.

Going forward, a major challenge that the mining industry has to overcome is whether exploration efforts are sufficient to grow the resource base and meet future, expected demand for metal. This is because even after adjusting for inflation, exploration expenditures are highly cyclical. This peculiarity manifests itself with exceptional considerations to explorers. In the “boom� part of the cycle, the concerns will surround gaining access to good ground and being able to operate effectively in a “hot� market for labour and equipment. In the “bust� part of the cycle, the companies will need to control their expenditure in the face of limited access to funds.

There are a number of reasons why exploration is such a high-risk endeavour and there may be years between major discoveries. COVID-19 may also impact the exploration plans for companies of various sizes, and as production from existing mines is expected to begin decreasing from 2022, assets that can be developed in the medium term may see their values increase.

Mining companies may contact Clean Earth Technologies to learn more about optimising and capitalising their existing gold mine assets to retrieve gold in a safe, clean, and sustainable way. Clean Earth Technologies’ non-toxic, cyanide-free gold recovery reagent for mining operators will allow for the effective and efficient extraction of gold from ore, and an optional de-watering process will allow operators to avoid creating tailings dams facilities.

____________________________

[1] Kevin Murphy, “A Decade of Underperformance for Gold Discoveries,� (S&P Global Market Intelligence, June 4, 2020), https://www.spglobal.com/marketintelligence/en/news-insights/blog/a-decade-of-underperformance-for-gold-discoveries​.